“In theory there is no difference between theory and practice. In practice, there is.”

-Yogi Berra

Many investors believe, in theory, that asset classes are diversified. In practice, they have overlapping risks and are often less diversified than one might think. This gap between theory and practice, to us, results from an imperfect understanding of what drives portfolio risk.

Typical “Credit” Exposures Are More Than Just Credit

For example, let’s use Venn to take a look at the factor contribution to risk of a typical credit exposure, such as the SPDR Bloomberg High Yield ETF (HY ETF).

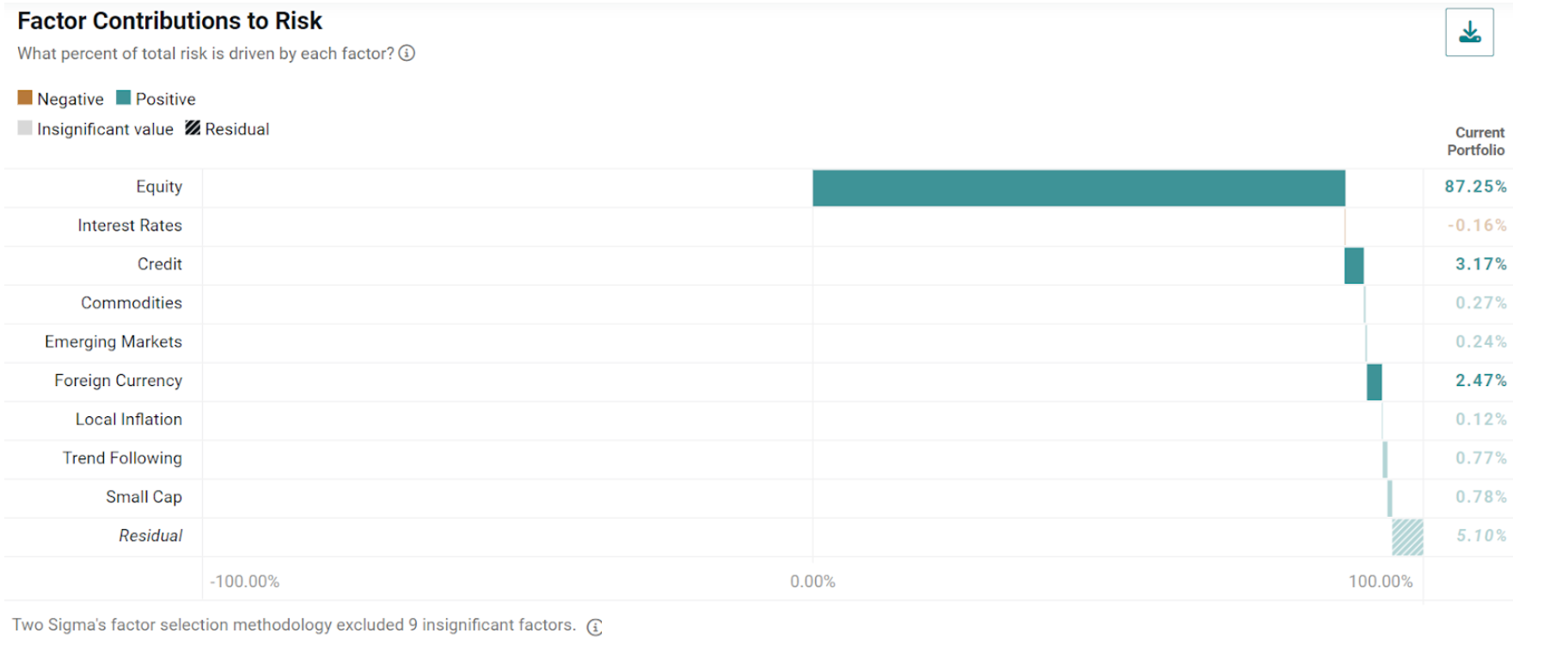

Perhaps surprising to some, we found that historically the equity factor has driven the majority of risk for this fixed income fund at 33%.1 Furthermore, when we created a 50/50 portfolio using this HY ETF and broad global equities, the equity factor would have contributed 87% to total risk.2

Factor Contribution to Risk of a 50/50 Portfolio of High Yield and Equity

Source: Venn by Two Sigma. The chart displays factor analysis for a 50/50 split between the SPDR Bloomberg High Yield ETF and iShares MSCI ACWI ETF viewed through the Two Sigma Factor Lens from 3/27/2008–11/23/2023

Despite half of this portfolio being a type of fixed income and the other equity, it turns out they are not very diversifying together. This is a critical insight when discerning the difference between the theory of understanding portfolio risk, and the practice of it.

Venn’s Factors Are Independent and Diversifying

Many investment categories, including asset classes, are concoctions of common risk factors. At Venn, we believe that independent risk factors spanning across asset classes are more precise tools for investment analysis. Viewing risk this way may help to better understand portfolio diversification and the impact of decision making.

This is why the Two Sigma Factor Lens that powers Venn:

- Evaluates investments with a parsimonious lens of risk factors rather than asset classes.

- Aims for all 18 risk factors to be orthogonal, or statistically independent.

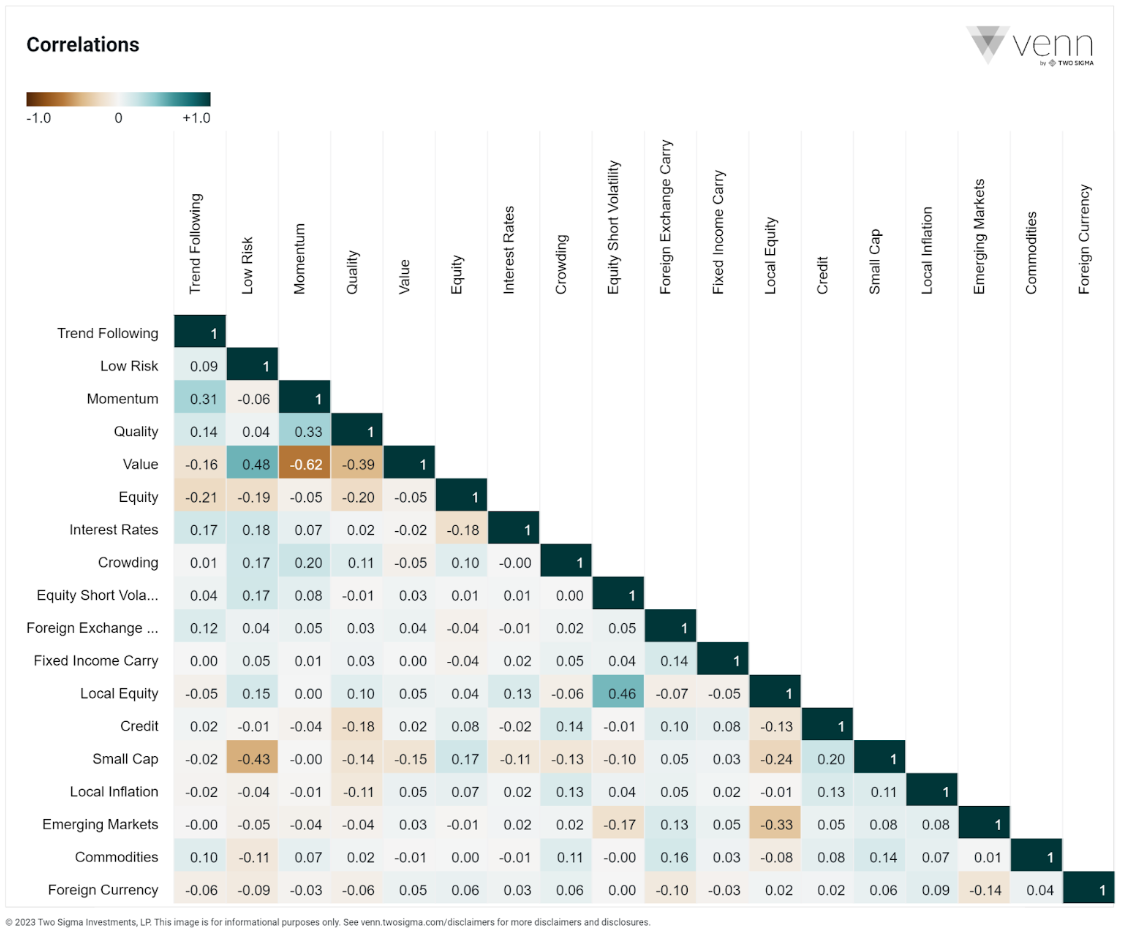

The second point is really the key. Within Venn, we can show how virtually every factor correlation pair, via our construction, is low or close to zero (below). This creates a precise and independent lens with which to view portfolios and make investment decisions. Put another way, an allocator seeing relatively dispersed exposure to multiple factors in the Two Sigma Factor Lens can be more assured that their portfolio is diversified among many independent sources of return.

Source: Venn by Two Sigma. The chart displays a correlation matrix for all 18 factors in the Two Sigma Factor Lens over their full history from 10/3/1997-11/23/2023

Using Venn to Close the Gap

Viewing a portfolio from an asset class perspective has its benefits, including intuitive categorization and a wealth of available research. However, we believe a purer approach to risk can also be additive. By viewing investments through a risk lens made up of independent factors, in our view, it’s easier to understand the true diversification of a portfolio and the deeper factors at play.

Venn is unique in that it uses Two Sigma research and industry leading technology to deliver this independent factor lens pre-packaged, closing the gap between the theory of understanding portfolio risk, and the practice of it. Borrowing another quote from Yogi Berra:

“if you don’t know where you’re going, you’ll end up someplace else.”

-Yogi Berra

This post marks the first in a series of four on the fundamental pillars of Venn (see below). Stay tuned for an upcoming post on another core pillar.

- Holistic, by capturing the large majority of cross-sectional and time-series risks for typical institutional portfolios.

- Parsimonious, by using as few factors as possible.

- Orthogonal, with each risk factor capturing a statistically uncorrelated risk across assets.

- Actionable, such that desired changes to factor exposure can be readily translated into asset allocation changes.

References

1 Source: Venn by Two Sigma. Period from 3/27/2008–11/23/2023

2 Source: Venn by Two Sigma. Broad global equity represented by the iShares MSCI ACWI ETF. Period analyzed from 3/27/2008–11/23/2023

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Any statements regarding planned or future development efforts for our existing or new products or services are not intended to be a promise or guarantee of future availability of products, services, or features. Such statements merely reflect our current plans. They are not intended to indicate when or how particular features will be offered or at what price. These planned or future development efforts may change without notice. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

This article may include discussion of investing in virtual currencies. You should be aware that virtual currencies can have unique characteristics from other securities, securities transactions and financial transactions. Virtual currencies prices may be volatile, they may be difficult to price and their liquidity may be dispersed. Virtual currencies may be subject to certain cybersecurity and technology risks. Various intermediaries in the virtual currency markets may be unregulated, and the general regulatory landscape for virtual currencies is uncertain. The identity of virtual currency market participants may be opaque, which may increase the risk of market manipulation and fraud. Fees involved in trading virtual currencies may vary.

.png)