Tools for Sophisticated Investment Teams

Forged from the quantitative expertise of Two Sigma, Venn provides access to intuitive tools and deep datasets to power strategic and tactical asset allocation.

Watch a 2-Minute Venn Overview

Helping investment professionals move faster, increase precision, and generate results.

Investment Due Diligence

Get an in-depth view into current or prospective investments, including private assets, and conduct comprehensive manager performance and risk assessment.

Portfolio Construction

Incorporate our strategic and tactical portfolio construction tools into your existing workflows. Explore how a factor approach can provide new insight into your portfolio.

Deep Datasets

Access 100,000+ public funds, ETFs, equities and indices, plus additional datasets including digital and private assets, or upload your own data.

Robust Reporting

Our Report Lab module was designed to streamline the creation of presentations, proposals, slides, and more. Use it to tell your story and present with confidence.

Why Clients Use Venn

Our clients use Venn to help them quickly answer critical investment, risk, and portfolio questions and have confidence in the results.

Access Intelligent Technology

Venn simplifies complex workflows. See how we can help streamline multi-asset portfolio construction, attribution analysis, scenario analysis, forecasting, risk and performance reporting, and more.

Connect to Advanced Quantitative Analytics

Venn provides access to sophisticated tools and data to help power strategic analysis and decision-making.

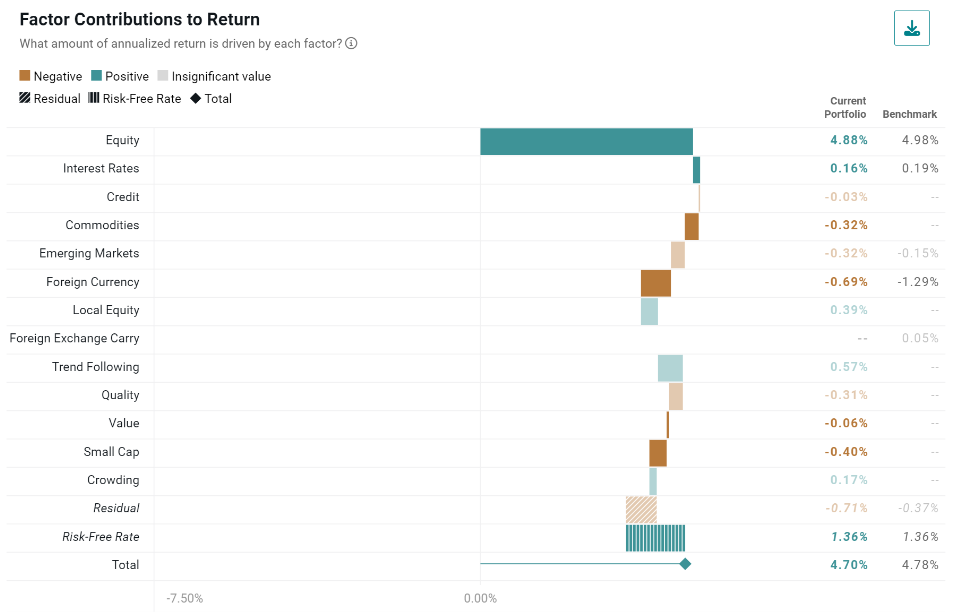

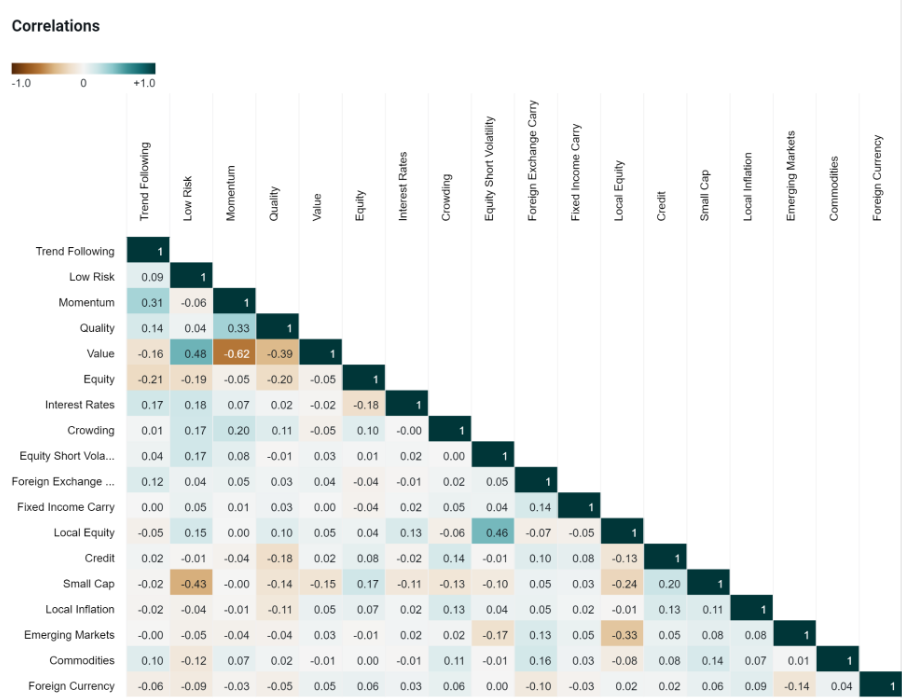

What Are Factors?

Factors are unique sources of risk and return, and that are common across asset classes. Two main types of factors have driven risk and returns over time: macroeconomic factors and style factors. The former captures broad risks across asset classes while the latter seeks to explain risk within asset classes.

Core Macro

Secondary Macro

Macro Styles

Equity Styles

Resource Guides

Client Spotlight

Heartland Trust's largest challenge was finding a differentiated way to analyze risk in detail.

See Venn in Action

Watch a recent Venn webinar showcasing our analytics platform and Report Lab module.

Revisiting the Two Sigma Factor Lens

Our framework for a factor approach to investment analytics.