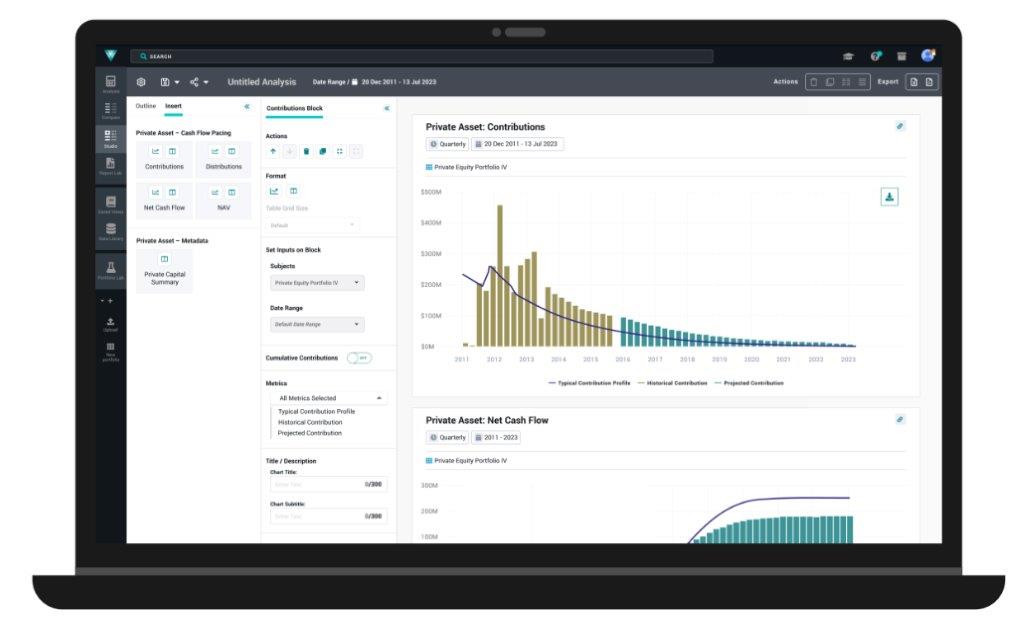

Private Asset Lab

Introducing our new, premium data and analytics solution that powers analysis and confident decision-making for Private Assets.

Why Private Asset Lab?

Designed for investors who have, or are considering, exposure to private assets and are looking for deeper insight into possible portfolio impact. Private Asset Lab is a robust extension to the Venn platform and puts scientific techniques, private asset datasets, and purpose-built analytics into clients’ hands to facilitate seamless multi-asset portfolio analysis.

Developed with extensive client-feedback, we are excited to launch a new set of tools and data while continuing to build and release deeper private asset capabilities over time.

What is Private Asset Lab?

A new solution for Private Asset investors, incorporating extensive data and purpose-built analytics.

Increased Transparency

Desmoothing, interpolation, and extrapolation help mark private asset returns to the market and increase frequency.

Cash Flow Modeling

Manage a variety of risks associated with private asset portfolios including funding risk.

Private Asset Data

Cash flow and performance data for 7,000+ funds and private equity indices and benchmarks.

Metadata

Name, vintage, strategy, and more with over 75,000 profiles.

Increased Transparency

Use Venn to access a universe of data and to power institutional-grade analytics for Private Asset investments

Private Asset Lab is subject to additional fees.

Desmoothing, extrapolation, and interpolation use historical data and relationships among proxies to make estimates. These estimates will not always predict future results and have inherent limitations. Cash flow modeling is dependent on assumptions of uniform fund behaviors according to fund characteristics, and historical data availability. The future cash flow timing and needs of specific investments will differ from the model results, at times significantly.