Wealth Managers and Advisors

Venn’s portfolio analytics platform can help construct multi-asset portfolios, evaluate investments, manage risk, and generate proposals for clients.

Venn Use Cases

Venn was designed for critical advisor and wealth manager workflows. Our portfolio analytics help advisors take a quantitative approach to multi-asset portfolio management, and can help deliver enhanced insights for allocation decisions. Report Lab helps you quickly construct polished reports and proposals, craft your narrative, and present with confidence.

Model Portfolio Construction

Manager Due Diligence

Risk and Return Attribution

Stress Testing and Scenario Analysis

Reporting and Proposal Generation

How Wealth Managers & Advisors Use Venn

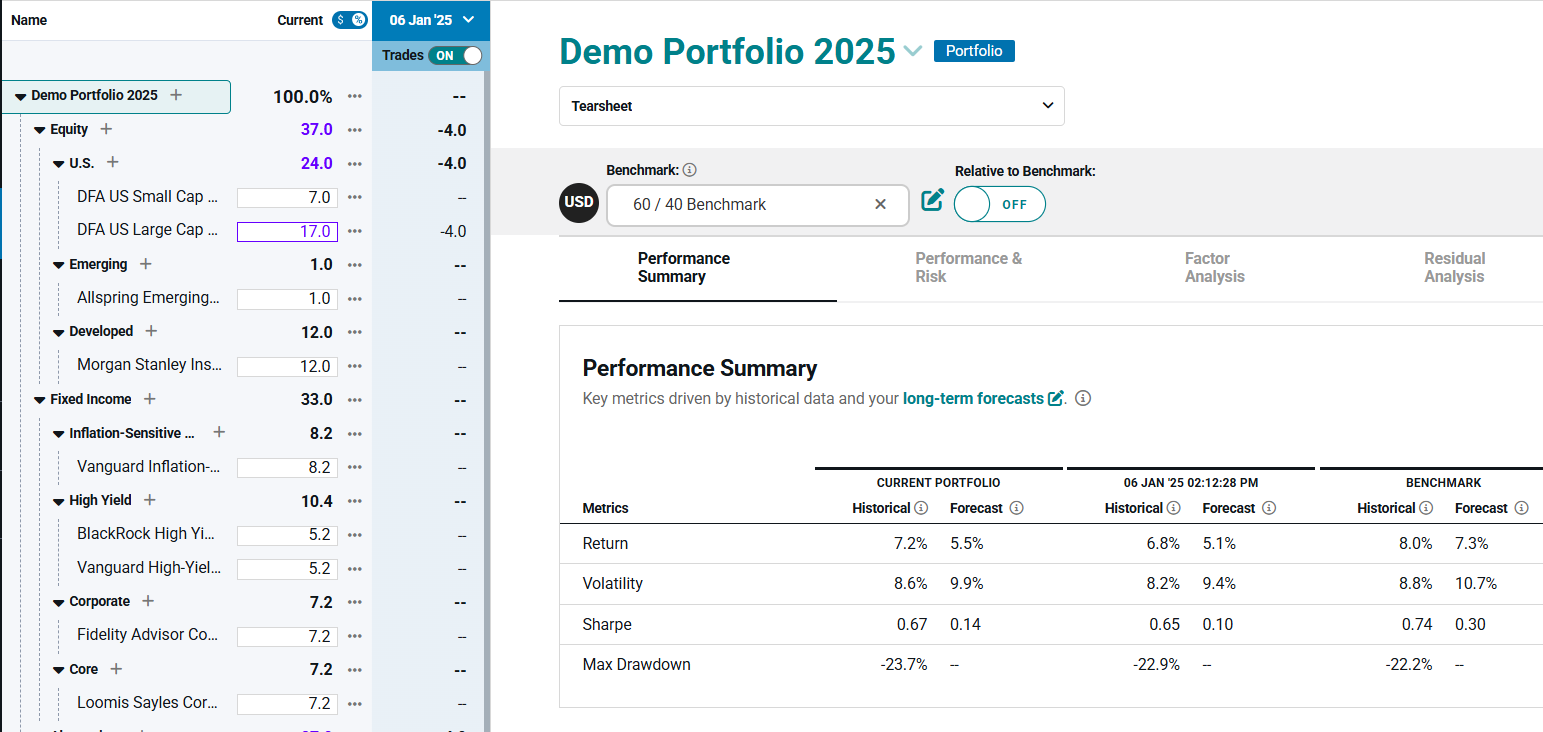

Portfolio Construction

Construct multi-asset portfolios, including public and private assets, change allocations on the fly, compare investments, and stress test.

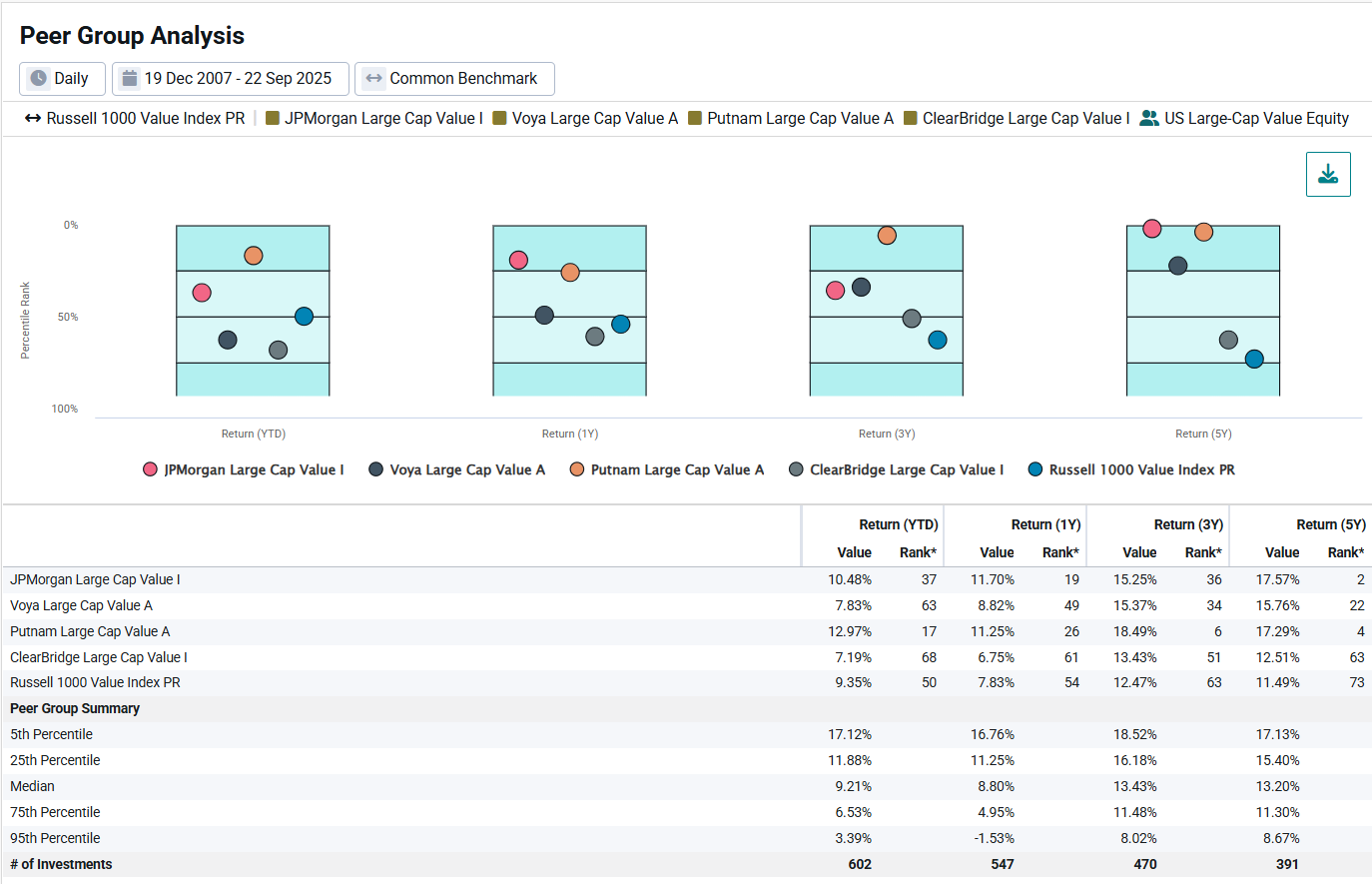

Manager Due Diligence

Break down manager risk and return, identify factor betas and residual components (e.g., alpha), do peer comparisons, and prepare for meetings.

Customizable Reporting

Produce client-ready reports and presentations, help comply with record-keeping rules, and eliminate manual processes.

Venn by the Numbers

250+

Clients

300,000+

Investments in Data Library

$25+ trillion

Client AUM

18

Factor Model

Venn provides insights into underlying factors contributing to both the return and risk within [client] portfolios. We are now able to dive deeper and continually track ongoing trends in order to assist in making portfolio decisions.

* The Venn subscriber featured here was not compensated for their statements. As a Venn subscriber, their use of portfolio analytics or other Venn features and their experience could differ from your organization’s due to their particular use of Venn, the version of Venn used, or other factors. Not all subscribers will be equally satisfied. The person providing this testimonial was selected based on a variety of factors, some of which are subjective. This document is for informational purposes only. Not an offer to buy or sell securities. Click here for Important Disclosure and Disclaimer Information.

Brockenbrough Streamlines Their Portfolio Analysis Process

At Brockenbrough, streamlining the time and labor intensive process of gathering data from clients’ portfolios and running analytics allows the team to spend more time interpreting the analyses.

Common Questions

What is the Venn connection to Two Sigma?

What goes into our Factor Model?

What is Private Asset Lab?

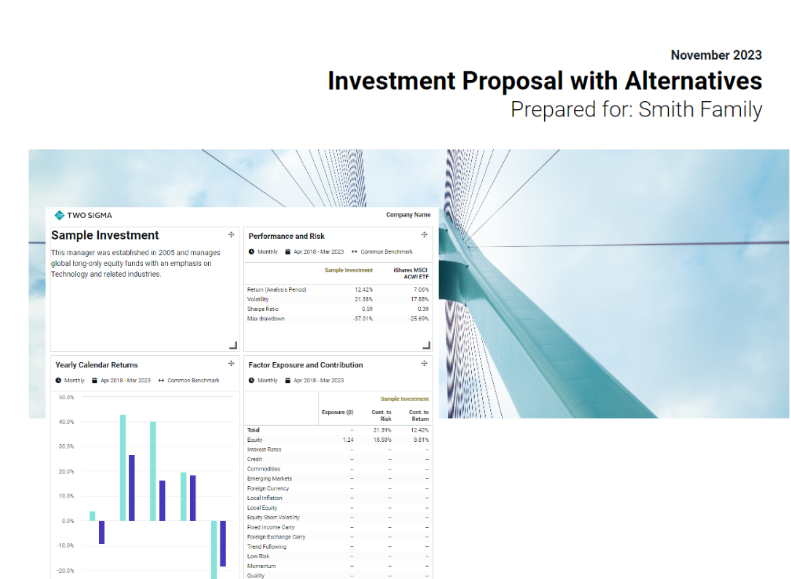

What is Report Lab?

Thought Leadership

Market, Industry, and Analytical Insights

Analyzing Private Assets

Private Asset returns are often smoothed and infrequent, reducing transparency. Venn tools can help view these assets through a public market lens.

2025 WealthTech Americas Award

Venn is pleased to announce it has been named the winner in the Risk Monitoring and management category in the 2025 WealthTech Americas Awards.

Three Ways to Use Venn's Report Lab

Report Lab was designed to streamline the creation of presentations and proposals, allowing you to tell your investment narrative with customization and personalization.