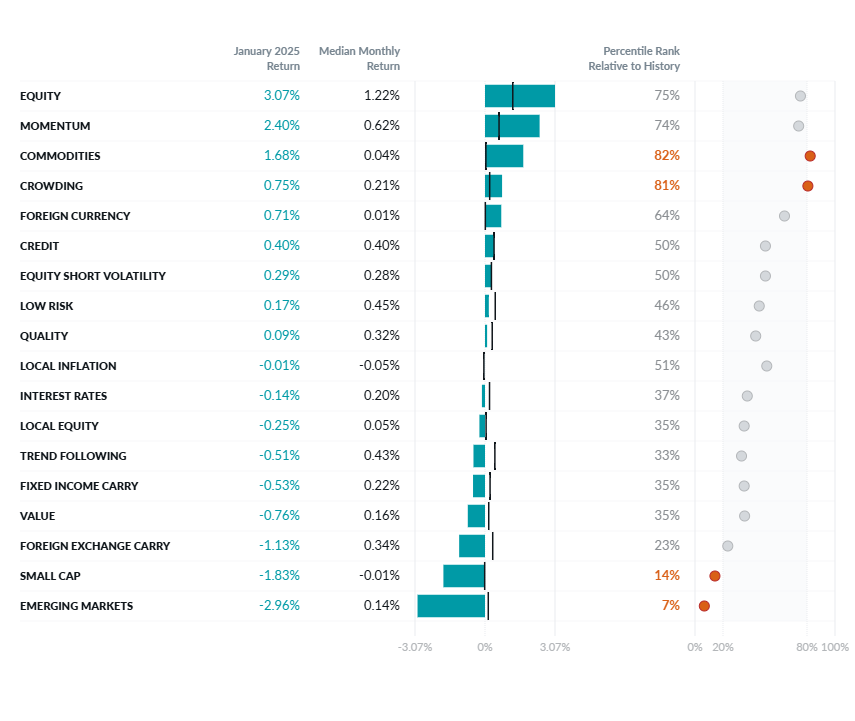

Exhibit 1: January Performance of the Two Sigma Factor Lens

©2025 Two Sigma Investments, LP. This image is for informational purposes only. See https://www.venn.twosigma.com/blog-disclaimer for more disclaimers and disclosures.

Source: Venn by Two Sigma. The median and percentile columns measure the performance of each factor in the Two Sigma Factor Lens relative to the entire history of the factor in USD, using monthly data for the period August 1998 - January 2025

However, right before January’s curtain call, there was one last opportunity for shock and awe. DeepSeek, a Chinese AI startup, claimed its latest AI models are “on a par or better than industry-leading models in the United States at a fraction of the cost.”2 This challenged prevailing market assumptions about AI leadership, and the energy and resources required to realize AI potential. For example, on January 27th our global Equity factor fell over 1%, with AI titan Nvidia falling -17.0% on that single day.

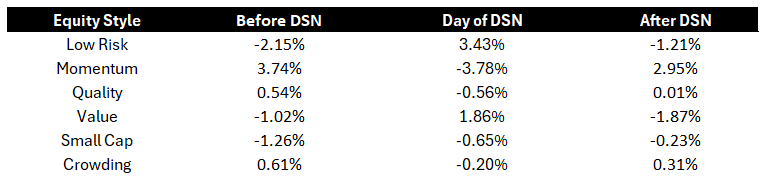

Equity Style Performance: The DeepSeek News Cycle

Our global long/short and beta-neutral Equity Styles serve as a barometer for institutional investors’ return-seeking strategies within equities.3 Additionally, the “AI” theme in markets has most commonly manifested itself within equities. This isn't limited to household names like Nvidia either; it extends to other securities including those associated with the infrastructure needed to power AI innovation.

Given this landscape, we zeroed in on our Equity Styles to dissect the market’s reaction before, the day of, and after the DeepSeek news (DSN).

Exhibit 2: January Equity Style Performance Before, the Day Of, and After DeepSeek News

Source: Venn by Two Sigma. Before = 1/1 – 1/26. Day of= 1/27. After= 1/28–1/31.

Before DeepSeek News: Before the DSN, January performance echoed some 2024 themes. Low Risk and Momentum continued their “tug-of-war”, exhibiting opposite directional performance. Notably, both factors had a strong 2024, but Low Risk continued its downward trend that began in September of last year. This indicates a persistent market preference for high-risk equities over this period.

In terms of our Small Cap factor, despite some market participants seeing tailwinds for small caps due to the new administration in the U.S., our global Small Cap factor continued its 2024 underperformance.

Crowding’s performance also deserves a special mention. This Equity Style tends to have much lower volatility than the others, giving it a lower hurdle to determine its performance as significant. Being positive indicates that highly shorted stocks underperformed those stocks that are not highly shorted. This validates collective investor wisdom beyond what other equity styles could explain (Venn’s use of residual short interest allows for this insight).

Day of DeepSeek News: January 27th marked an upset of the status quo as news of DeepSeek’s high-quality but cost-effective AI models reverberated throughout markets. As shown in Exhibit 2, the reversal in Equity Style performance was clear when compared to performance before the news.

Similar to 2024, we saw the opposite positioning of Momentum and Low Risk in action.

- Momentum experienced negative performance, suggesting a sudden lack of faith in prevailing equity market trends. One of Momentum's largest long positions was Nvidia, dragging on returns.

- Conversely, Low Risk was the day’s largest outperformer. Investors spooked by the potential disruption of the AI landscape gravitated towards equities with a lower risk profile. One of Low Risk’s largest short positions was Nvidia, further boosting its performance.

In terms of small caps, one might expect that a headwind for mega-cap tech would benefit a long/short Small Cap factor. After all, shouldn't DSN level the AI playing field, allowing smaller companies to compete more effectively?

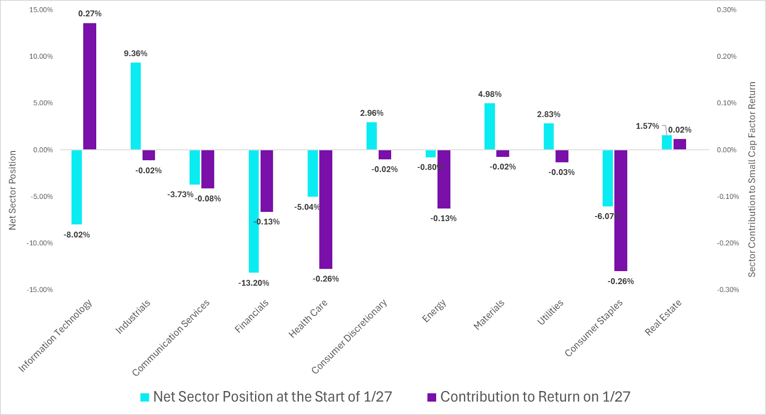

The reality, as shown in Exhibit 3, is more nuanced. While this logic isn't entirely flawed, it may overemphasize a single theme among more complex dynamics.

- Our Small Cap factor's second-largest net short position in Information Technology did indeed benefit significantly on the day of DSN, adding 27 bps to return.

- However, this gain was offset by negative contributions from nearly every other sector. For instance, net short positions in Health Care and Consumer Staples dragged on returns as large caps outperformed within these sectors.

Exhibit 3: Contribution to Return by Sector for Our Small Cap Factor on the Day of DSN

Source: Venn by Two Sigma

Crowding also underperformed on this day, with highly shorted stocks outperforming their less-shorted counterparts. As mentioned earlier, this factor measures residual short interest above and beyond other equity styles, as a way to measure another layer of aggregate investor views. Its negative performance on this day implies a reversal in investor sentiment, distinct from other factors such as Momentum.

More generally speaking, this DSN shock, while brief, may provide some insight into which factors could benefit if the AI train gets derailed. At least with current positioning, it may be the case that exposure to our version of Low Risk or Value could act as a hedge if the AI trade goes south. Their positive performance was a clear stand out on this day, even when compared across all 18 of our factors.

After DeepSeek News: In the four remaining trading days of January following DSN, every equity style experienced directionally opposite performance from the day of the shock. This rapid reversal suggests that while headlines erupted– exemplified by Nvidia’s eye-popping 17% drop– investors quickly regained their composure. This includes our Equity factor rallying 72bps in the final four trading days, after falling -1.01% on the day of DSN news.

References

3 If you’d like to learn more about our Equity Style methodology, click on the link posted in the sentence. Note that Crowding is not global as it only considers U.S. securities.

References to the Two Sigma Factor Lens and other Venn methodologies are qualified in their entirety by the applicable documentation on Venn.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.