Exhibit 1: October Performance of the Two Sigma Factor Lens

©2024 Two Sigma Investments, LP. This image is for informational purposes only. See https://www.venn.twosigma.com/blog-disclaimer for more disclaimers and disclosures.

Source: Venn by Two Sigma. The median and percentile columns measure the performance of each factor in the Two Sigma Factor Lens relative to the entire history of the factor in USD, using monthly data for the period Oct 1997 - October 2024.

- Interest Rates: Our Interest Rates factor is long currency-hedged global bonds, meaning negative performance typically coincides with rising yields.

For example, last month we wrote about the beginning of the U.S. rate cutting cycle and its impact on factors. Though the tangible effects of the rate cut may take time, market expectations shift with each new data release. In particular, the “sticky” September inflation report and strong hiring data accelerated already weakening expectations for future cuts.1 This contributed to a rise in yields, negatively impacting our Interest Rates factor.

The upcoming U.S. presidential election may also have contributed to rising yields. For example, some believed a Republican victory would result in higher inflation due to policies surrounding tax cuts and tariffs.2 Selling pressure and demand for higher yields may have taken place as a result of this expected outcome.3 This included the possibility of a Republican sweep across all branches, making successful implementation of these policies more likely.

No matter the cause, rising global yields, especially in the U.S., ultimately led to negative performance for our Interest Rates factor in October.

Exhibit 2: Interest Rates Factor Performance and the U.S. 10-Year Yield in October

Source: Venn by Two Sigma

- Fixed Income Carry: Our Fixed Income (FI) Carry factor is both duration-neutral and designed to be uncorrelated with our Interest Rates factor.

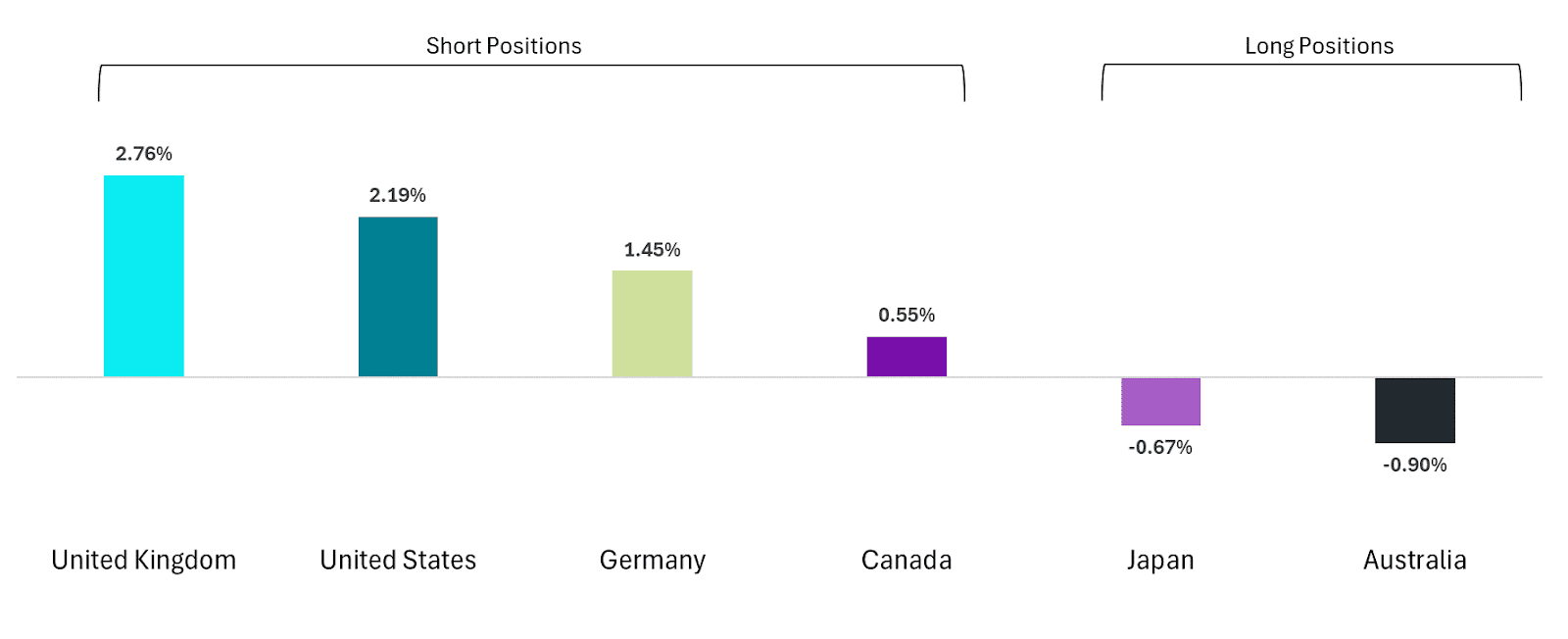

The raw Fixed Income Carry input was up around 5.4% for the month with the majority of positive return driven by its short basket. Specifically, short exposure to U.S., German, and U.K. 10-year bond futures.

Given that yields rose across all 10-year bonds in our FI Carry factor, every short position was a tailwind while every long position was a headwind. Despite this, investors exposed to our systematic FI Carry factor likely benefited from strong October performance due to the disproportionate benefit of their short positions.

Exhibit 3: Contribution to Return by Country For the Raw Fixed Income Carry Factor Input

Source: Venn by Two Sigma

- Trend Following: Our Trend Following factor is made up of four sleeves across equities, commodities, currencies, and fixed income. It was net long fixed income in October as, generally speaking, bonds have done well over the last six months to a year.

Asset repricing—like October's bond repricing (see Exhibit 2)—typically drags on Trend Following performance. This factor relies on consistent trends to generate positive returns. As a result, Trend following’s net long fixed income position faced headwinds in October amid broad rising rates. Fixed income Trend Following was by far the largest negative contributor to return (Exhibit 4).

- Foreign Currency: In October, the U.S. Dollar Index (DXY) was up 3.17%, indicating a strong appreciation of the USD relative to other major currencies.4

Our Foreign Currency factor captures a similar dynamic, but from a different perspective. It measures how a short position in the USD and long positions in foreign currencies perform after accounting for related market factors such as Interest Rates, Equity, Credit, and Commodities. Significant negative performance of our FX currency factor in October suggests the USD became meaningfully stronger relative to the rest of the G10, after removing the influence of these other correlated factors.

A stronger USD likely reflects reduced rate cut expectations and markets pricing in a potential Trump victory (through higher yields). If rates are higher in the near term than previously expected, it is likely the case that USD demand will also be higher, strengthening the dollar. These themes acted as a headwind for the U.S.-based investors with Foreign Currency factor exposure in October. - Equity: While our Equity factor did not have historically negative performance, it is a tier 1 macro factor and it did exhibit meaningfully negative returns. Some of this may be due to weakening rate cut expectations, but uncertainty around the upcoming U.S. presidential election may also have been a contributor.

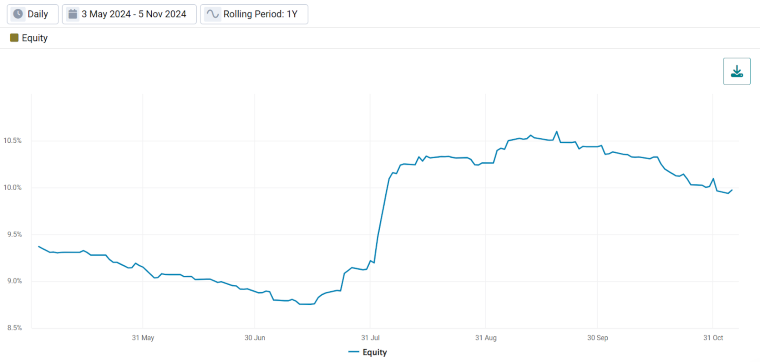

Our recent research found that it was common for Equity factor returns to be lower, and volatility higher, in the six months before recent U.S. presidential elections rather than afterwards. However, we also found that while volatility is typically higher, it often decreases as election day approaches. As we can see in Exhibit 4, this trend was not completely consistent for the 2024 election. Volatility did trend downward in the final few months leading to the election, but ultimately finished the period higher than it started. Of course, current economic conditions should be considered alongside these trends, as a slew of other things can affect equity market volatility.

Exhibit 5: Rolling Six-Month Equity Factor Volatility Before the 2024 U.S. Presidential Election

Source: Venn by Two Sigma

References

1 https://www.cnbc.com/2024/10/10/cpi-inflation-september-2024.html and https://www.reuters.com/markets/rates-bonds/feds-daly-says-monetary-policy-still-working-lower-inflation-2024-10-15/

4 Source: Bloomberg

References to the Two Sigma Factor Lens and other Venn methodologies are qualified in their entirety by the applicable documentation on Venn.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.