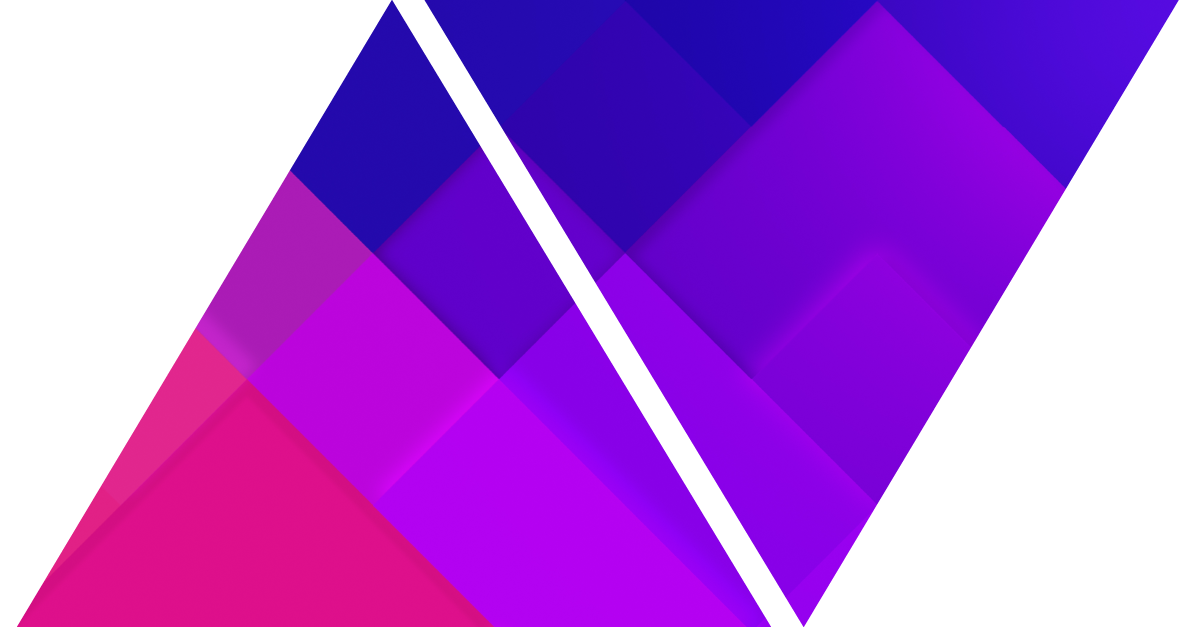

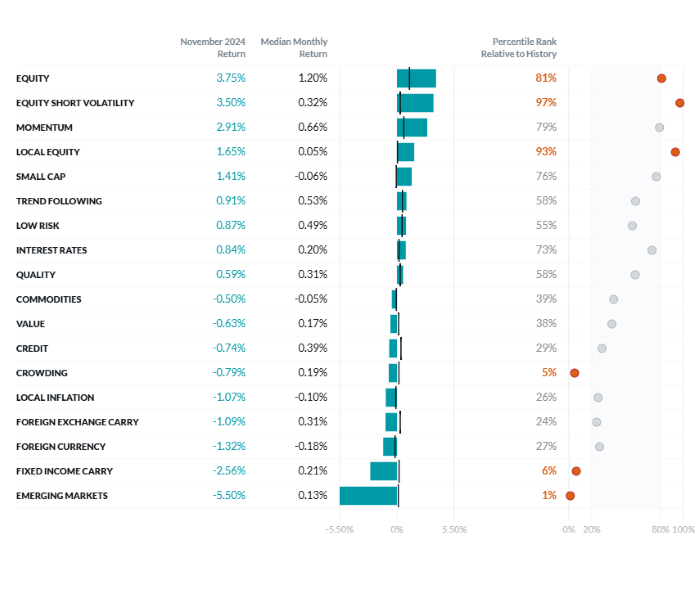

Exhibit 1: Two Sigma Factors Lens Performance in November

©2024 Two Sigma Investments, LP. This image is for informational purposes only. See https://www.venn.twosigma.com/blog-disclaimer for more disclaimers and disclosures.

Source: Venn by Two Sigma. The median and percentile columns measure the performance of each factor in the Two Sigma Factor Lens relative to the entire history of the factor in USD, using monthly data for the period Oct 1997 – November 2024

Getting More Precise with Fundamental and Independent Factors

Our Equity factor seemed to be a clear beneficiary of the Republican victory. As we can see in Exhibit 1, it was up 3.75% in November, among the best months in its history.1 However, doesn’t a global equity rally impact most other asset classes? This interconnectedness can make it challenging to isolate the ripple effects of the presidential election. This is where thoughtful application of a factor lens may help.

Small Cap: The Republican victory brought tailwinds for small-cap equities, driven by the perceived benefits from themes such as tax cuts, deregulation, and an America-first mindset. For example, U.S. small-cap equities rose by 10.9% in November.2

But how does one understand how much of this performance was due to benefits specific to smaller companies, versus small caps having a roughly 1.22 beta to global equities?3 Our Small Cap factor is not only long/short but it also aims to be beta-neutral. This means that when we go long small caps and short large caps, each portfolio aims to maintain the same global equity beta. We believe our Small Cap factor makes a real attempt to remove Equity factor exposure.

Consequently, the return of 1.41% in November may provide a clearer representation of the benefits that small caps received from the election results, specifically due to their smaller market capitalizations.

Exhibit 2: Long Only Small Caps vs Venn’s Small Cap Factor, November Performance

Source: Venn by Two Sigma

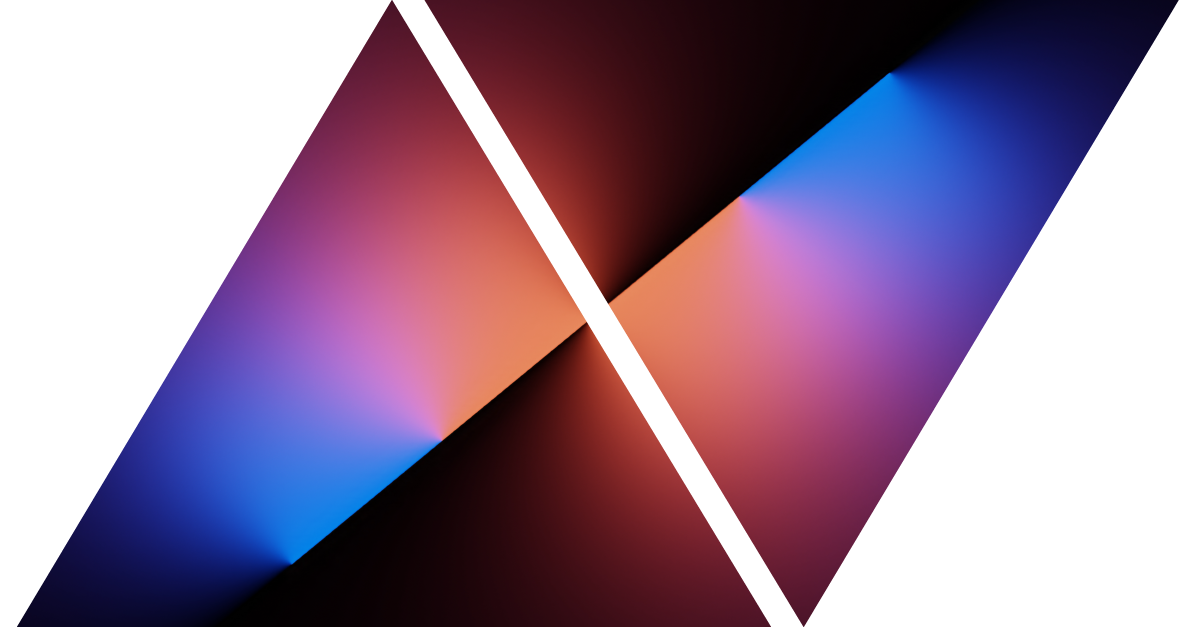

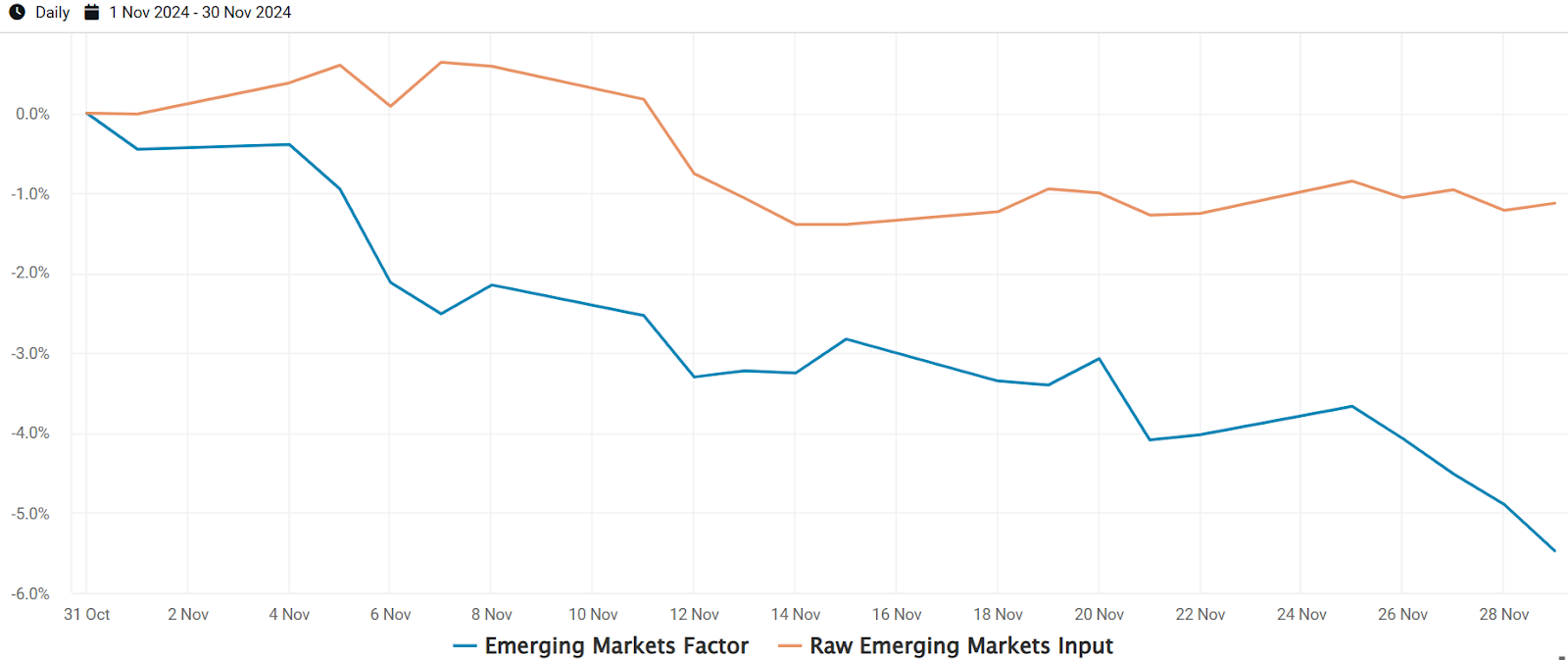

Emerging Markets: Our version of a pure Emerging Market (EM) factor attempts to remove the portion of return associated with Equity, Credit, Commodities, and Interest Rates from the raw input. In November, it experienced one of its worst monthly performances in its history. However, the negative performance of the raw input, which closely resembles an asset class understanding, was not as severe. More specifically, the raw input declined -1.13%, whereas our actual EM factor dropped by -5.50%.

This difference partly arises from removing the positive return that EM equities experienced simply by being equities when equities rallied. This suggests the negative effects of the election results on EM were much more pronounced when focusing on a purer representation. Therefore, if you expected EM to perform even worse amid tariffs and an America-first mindset, you were likely correct.

Exhibit 3: Raw Emerging Markets Input Versus Venn's Emerging Markets Factor, November Performance

Source: Venn by Two Sigma

Local Equity: The Two Sigma Factor Lens offers different currency versions depending on an investor’s location. Our performance reports are written from the U.S. perspective, so the Local Equity factor reflects performance unique to the U.S. stock market.

Our raw local equity input returned 6.22% in November. Yet it remains difficult to determine from this asset class perspective how much of this was influenced by broader equities versus performance tailwinds specific to the U.S. stock market. Our Local Equity factor, however, accounted for global equity exposure resulting in the 6.22% return being adjusted downward to 1.65%. While still positive, we believe this is a more precise representation of the benefits specifically associated with the U.S. stock market.

Exhibit 4: Raw Local Equity Input Versus Venn's Local Equity Factor, November Performance

Source: Venn by Two Sigma

Using a Factor Lens to Better Understand the Impact of the Republican Victory on Investor Portfolios

In each of our three examples, analyzing asset classes to understand the effects of the Republican victory, in both the White House and Congress, can be helpful, but may obscure the underlying drivers of performance. As discussed, fundamental factors may offer a more nuanced understanding on how well-known systematic risks reacted to the election results. It is important to note that output generated by each factor relies heavily on its construction. However, we generally believe that an approach that seeks to define unique and independent risks will have the opportunity to be more precise than an asset class understanding.

This becomes particularly important when regressing a multi-asset portfolio against these factors. For example, users of the Two Sigma Factor Lens might find that Small Cap and Local Equity exposure contributed slightly less, while Emerging Market exposure was a little more detrimental, than an asset class interpretation might suggest in November. Instead, they might find some of that “missing” impact is captured in other factor exposures, such as Equity. On this note, it is important to remember that these factors are tools to be used in factor analysis. The key to understanding their impact lies in an investor’s exposure to them within their portfolio.

References

1 Most of this likely came from dominant U.S. exposure in global equities, a concept we previously discussed. For example, the iShares Core S&P 500 ETF (IVV) was up 5.9% in November whereas the iShares MSCI EAFE ETF (EFA) was down -0.2%.

2 Measured by the iShares Core S&P Small-Cap ETF (IJR).

3 Beta of IJR to the iShares MSCI ACWI ETF (ACWI) over the trailing 5 years ending 12/3/2024.

References to the Two Sigma Factor Lens and other Venn methodologies are qualified in their entirety by the applicable documentation on Venn.

This article is not an endorsement by Two Sigma Investor Solutions, LP or any of its affiliates (collectively, “Two Sigma”) of the topics discussed. The views expressed above reflect those of the authors and are not necessarily the views of Two Sigma. This article (i) is only for informational and educational purposes, (ii) is not intended to provide, and should not be relied upon, for investment, accounting, legal or tax advice, and (iii) is not a recommendation as to any portfolio, allocation, strategy or investment. This article is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. This article is current as of the date of issuance (or any earlier date as referenced herein) and is subject to change without notice. The analytics or other services available on Venn change frequently and the content of this article should be expected to become outdated and less accurate over time. Two Sigma has no obligation to update the article nor does Two Sigma make any express or implied warranties or representations as to its completeness or accuracy. This material uses some trademarks owned by entities other than Two Sigma purely for identification and comment as fair nominative use. That use does not imply any association with or endorsement of the other company by Two Sigma, or vice versa. See the end of the document for other important disclaimers and disclosures. Click here for other important disclaimers and disclosures.

.png)