Part 1

Private vs. Public Assets

A private asset is typically an investment that is not publicly traded. Private assets can be captured in various forms, such as equity, debt, real assets, etc. The value of private assets (on an ongoing basis) are usually determined through a quarterly valuation process, rather than being marked to the market on a daily basis.

Public investments are typically those that can be easily bought and sold, usually on exchanges. This means their value is typically marked to the market via daily transactions. Public assets include (but are not limited to) exchange-traded funds (ETFs), mutual funds, stocks, bonds, and futures contracts.

Choosing to Invest in Private vs. Public Assets

The choice to invest in both private and public assets has historically been geared toward institutional investors. Putting aside lofty investment minimums, private assets are typically less liquid than public assets, requiring a significant commitment of capital over long periods of time. Illiquid investments are typically best suited for a well-constructed investment plan and an investor who fully understands the risk of illiquid investments.

Private asset analytics are also complex compared to public investments, often requiring teams with specialized knowledge. This includes familiarity with private asset management concepts such as funding risk, cash flow management, or the legal obligations associated with investing in private capital. These specialized workflows also raise the cost to invest in private capital, requiring more research and analysis resources up front.

Private asset characteristics can make them more difficult to invest in than public assets. However, many investors are able to find unique value in private assets that may not be available in public markets. For example, venture capital investments may offer investors access to high growth companies that are not listed on a public exchange.

Technology is Making Private Assets More Accessible

Despite the challenges of private asset analytics, some platforms, such as Venn by Two Sigma, have helped to make such analyses more accessible to institutional and non-institutional investors alike.

Many private asset analytics begin with choosing a public market proxy as a reference point or benchmark. Broadly speaking, private and public assets should have similar exposures to many fundamental risk factors, such as economic growth or interest rates. This makes the appropriate public market proxy a reasonable point of reference for less transparent private assets.

Returns-Based Analysis

One technique for analyzing private assets alongside public markets is to use a representative exposure in a portfolio. For example, one could use the Preqin Private Equity Index in place of a set of private equity investments. However, even the performance of these representative indexes come with inherent challenges. They are typically smoothed, leading to artificially low volatility and lagged reactions to moves in public markets. They are also typically only valued on a quarterly basis, and are not up to date.

Technologies such as Venn’s Private Asset Lab can help address these issues to view private asset returns through a public lens. For example, Desmoothing, Interpolation, and Extrapolation, can use a public proxy as a reference point to address different challenges of private asset returns. In the chart below, we summarize the role of each technique at a high level.

The Steps to View Private Asset Returns Through a Public Lens

Source: Venn by Two Sigma. For illustration purposes only

Importantly, viewing private asset returns through a public lens may influence their role in a multi-asset portfolio. More in-depth analysis can lead to truer levels of diversification than what may be expected based on officially reported numbers alone.

A Venn webinar is available discussing these techniques as well as a deep dive paper.

Cash Flow Modeling

In private markets, limited partners (LPs) must commit capital up front to general partners (GPs), who can then call on that capital over time for investment. GPs will then distribute profits back to LPs over time. This framework can lead to significant periods of time when LPs wait for capital to be called by GPs, ultimately affecting investment performance. LPs also need to make sure they have enough capital on hand to meet commitments, or risk defaulting on payments. This dynamic can make private asset management quite difficult.

Cash flow modeling can help LPs by estimating future cash flows and projecting capital calls, distributions, net cash flows, and net asset values in the future. These analyses can provide powerful context for decisions around committing new capital, reviewing performance, and maintaining a certain private allocation as part of a larger portfolio.

Below we show net cash flows for an anonymous private equity fund, revealing the well known “J-curve” in private assets. This curve shows an example of how cumulative net cash flows begin as negative when capital is being called from the LP, but transition to positive as distributions begin to outweigh capital contributions.

Example of Net Cash Flows for a Private Equity Fund

Source: Venn by Two Sigma. For illustration purposes only. Certain data provided by Preqin Ltd. Copyright 2024 Preqin Ltd. All rights reserved.

At the portfolio level, cash flow dynamics can be even more complex. Assuming vintage diversity (a mix of private asset funds at different points in their life cycle), a portfolio of private assets can allow investors to meet capital calls with distributions from more mature funds. This can lead to a potentially self-sustaining allocation to private assets over time. However, investors must manage contributions and distributions simultaneously to maintain a desired asset allocation mix. Obtaining this balance can make accurate and reliable cash flow modeling at the portfolio level a very important tool to drive private asset management.

The second half of this Venn webinar discusses cash flow modeling in more depth.

Modeling Private and Public Portfolios Together

In the world of private investments, the worst-case scenario is often associated with defaulting on capital calls or funding failure–essentially, not having the liquid funds to pay private asset managers what investors contractually agreed to. This can spell both financial and reputational disaster for an investment plan.

While evaluating private assets on their own is useful, it's also important to consider that many investors have a public (liquid) portion of their portfolio. This liquidity sleeve can be utilized for both strategic and tactical funding, providing support to an overall investment strategy.

Given the complexities of managing both public and private assets, we need to go beyond the “worst-case scenario mental math” that we typically use in our day-to-day lives. Instead, we can use data-driven risk assessment to measure the probability of funding failure. Specifically, Venn’s total portfolio asset growth simulation can be thought of as two distinct methodologies working together:

- Public Portfolio: Two Sigma’s Factor Lens is used to generate a forecasted return and volatility. Monte Carlo simulations are then used to explore a myriad of possible future scenarios.

- Private Portfolio: Future cash flows and net asset values are modeled using fund-specific inputs alongside calibrated model parameters.

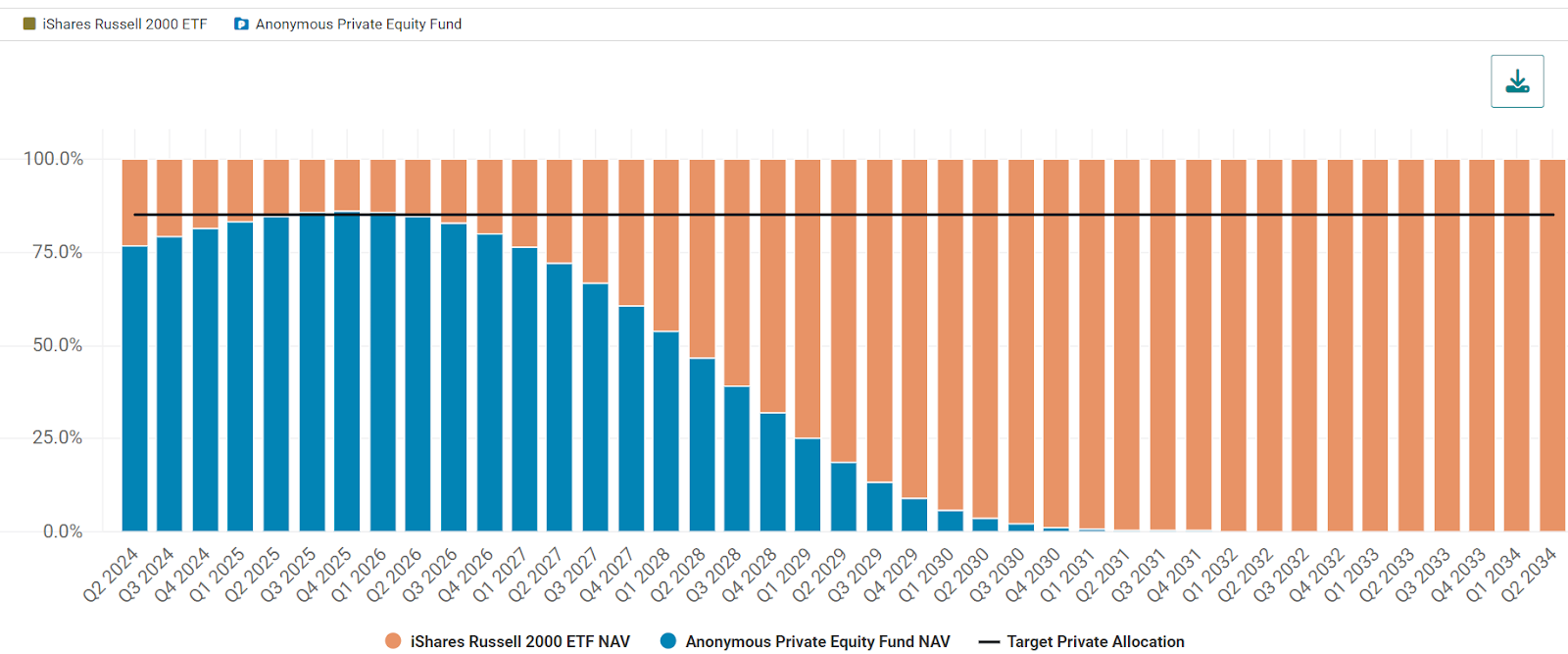

Maintaining a Consistent Private Asset Allocation

The benefits to using total portfolio asset growth simulation goes beyond understanding the probability of funding failure. It can also help model asset allocation between private and public investments.

Let’s say, for example, that our total portfolio targets around 85% in privates and 15% in public investments. We can track when our private allocation is projected to exceed or fall short of this target.

Example of Dynamically Balancing Estimated Allocations to Private and Public Investments

Source: Venn by Two Sigma. For illustration purposes only. Certain data provided by Preqin Ltd. Copyright 2024 Preqin Ltd. All rights reserved.

Public Market Equivalents

Private market funds are illiquid and involve complex orchestration of cash flows between LPs and GPs. More specifically, the timing and magnitude of these cash flows can meaningfully affect the resulting internal rate of return (IRR), the preferred performance metric for private assets.

In public markets, typically a time-weighted return (TWR) is used to measure performance. This return ignores when one purchases a fund, buys or sells shares, or liquidates a position. In other words, investor-specific cash flows are not accounted for.

IRR and TWR are not directly comparable, creating challenges when benchmarking private markets against public markets.

Public market equivalents are designed to create a level playing field to help investors confidently answer the question “did my private asset investment outperform its public benchmark, and if so, by how much?” An example of this type of analysis would be discounting the cash flows of a private asset by movements in a public index, before calculating its IRR.

It is important to note that off-the-shelf PME solutions typically don’t incorporate the friction associated with investing in private assets. Specifically, the performance hurdle that a private asset will need to overcome to justify an investment over public market alternatives is typically specific to each investment firm, and may also vary based on private asset risk, structure, or other criteria. This makes private asset integration with public assets an important decision.

The State of Private Assets

Most investors acknowledge that it is generally more difficult to invest in private vs. public assets. However, barriers to entry into private assets are coming down as general knowledge and availability of analytical tools have grown over time.

For example, Venn’s Private Asset Lab provides ways to: view private asset returns through a public lens, benchmark private assets to public markets, model future cash flows and probability of funding failure, and scan the investment universe with access to data for tens of thousands of private asset funds. Due to the operational challenges of private assets, technology may be an important catalyst for their continued growth. Platforms such as Venn may help investment teams understand their associated risks in a quicker and more intuitive way, while simultaneously needing fewer resources to begin or maintain a private asset allocation.

Private asset portfolios are less liquid than public asset portfolios and have additional risks, including the risk of loss. Desmoothing, extrapolation, and interpolation use historical data and relationships among proxies to make estimates. These estimates will not always predict future results and have inherent limitations. Cash flow modeling is dependent on assumptions of uniform fund behaviors according to fund characteristics, and historical data availability. The future cash flow timing and needs of specific investments will differ from the model results, at times significantly.